capital gains tax changes 2021

Long-term gains still get taxed at rates of 0 15 or 20. Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021.

Capital Gains Tax Definition Taxedu Tax Foundation

The annual exempt amount for capital gains tax will be cut from 12300 to 6000 next year and then to 3000 from April 2024.

. However if your investments end up losing money rather than generating. IRS adjusts tax brackets annually to keep up with inflation and recently introduced tax brackets for 2021. The current capital gain tax rate for wealthy investors is 20.

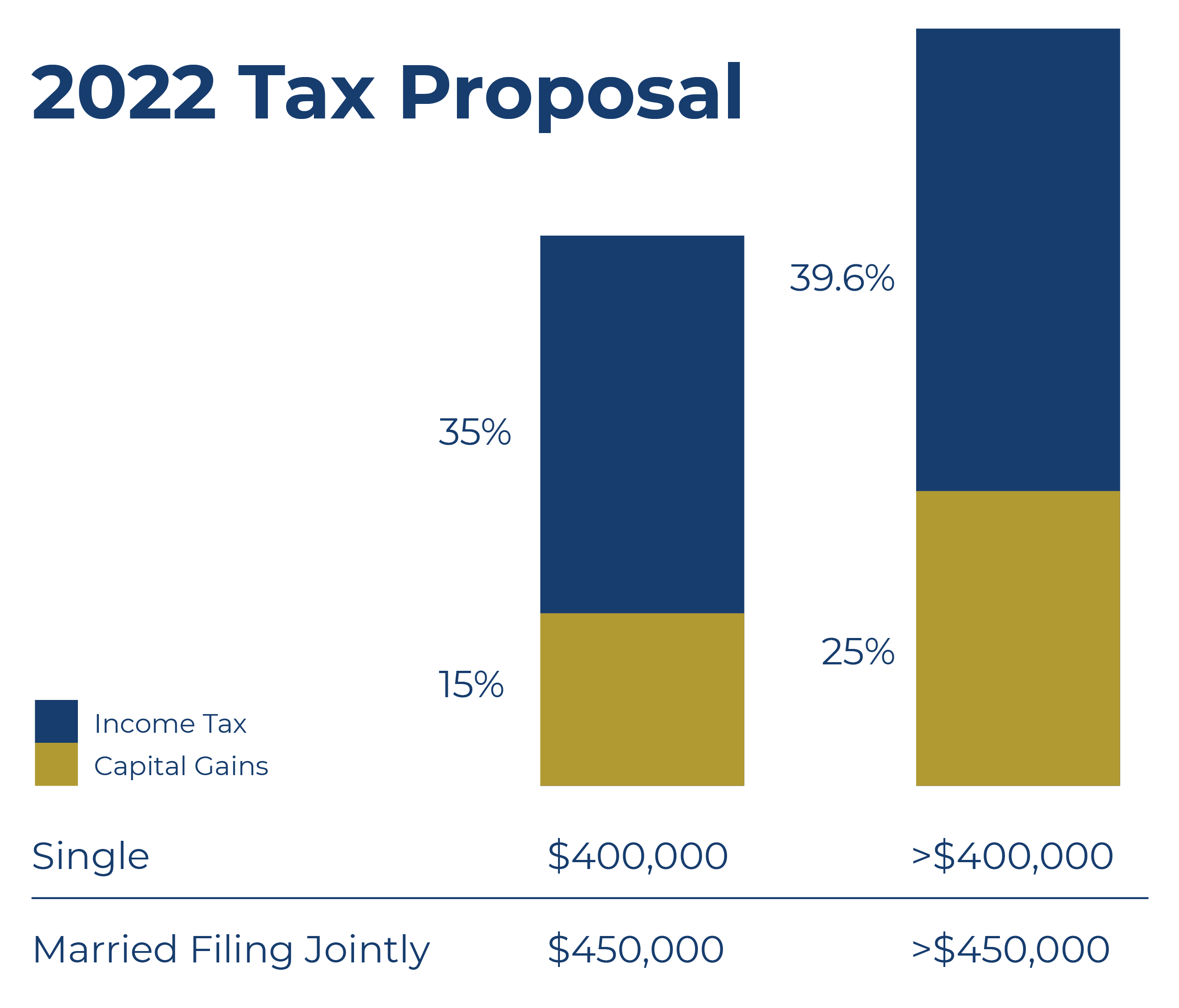

Capital gains taxes are also a hotly debated subject and changes could be on the way. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. Bring into line Capital Gains Tax with Income Tax A reduction in the annual level of Capital Gains Tax exemption could be.

1 day agoHe said yesterday. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. Raising the top capital gains rate for households with more than 1 million.

ONS recommendations on Capital Gains Tax are. The individual tax rate could just from 37 to 396 for those making more than 400000 annually. The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396.

Youll pay a tax rate of 0 15 or 20 on gains from the sale of most assets or investments held for more than one year. Add this to your taxable. Currently the top ordinary rate for individuals is 37 but the AFP also proposes a return to 396 for the top marginal tax rate for individuals.

Jeremy Hunt has reduced the exemption for capital gains tax from 12300 to 6000 while dividend allowance will be cut from 2000 to 1000. Its one of the biggest tax changes in more than a decade for Colorado. When calculating the holding periodor the amount.

Proposed capital gains tax Under the proposed Build Back Better Act the top. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to. Colorado taxpayers can be exempted from paying state taxes on capital.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. The necessary legislation will be introduced in Finance Bill 202122 and will also clarify that for UK residents where the gain relates to mixed-use property only the residential. President Joe Biden is aiming to raise the top tax rates on capital gains income and.

The brackets show how increments of your income will be taxed. From April 2025 electric vehicles will. It should also be noted that the net.

1 day agoDividend tax-free limit will be slashed as low as 500 and capital gains allowance to 3000 within 18 months Pensioners will get a 101 state pension rise to 10600 a year after. Should the triple-lock be retained and the state pension uprated by 101 next year the full flat-rate state pension paid to those reaching state pension age from 6 April. As previously mentioned different tax rates apply to short-term and long-term gains.

First deduct the Capital Gains tax-free allowance from your taxable gain. Once fully implemented this. These are the current rules but the Biden administration has proposed some changes.

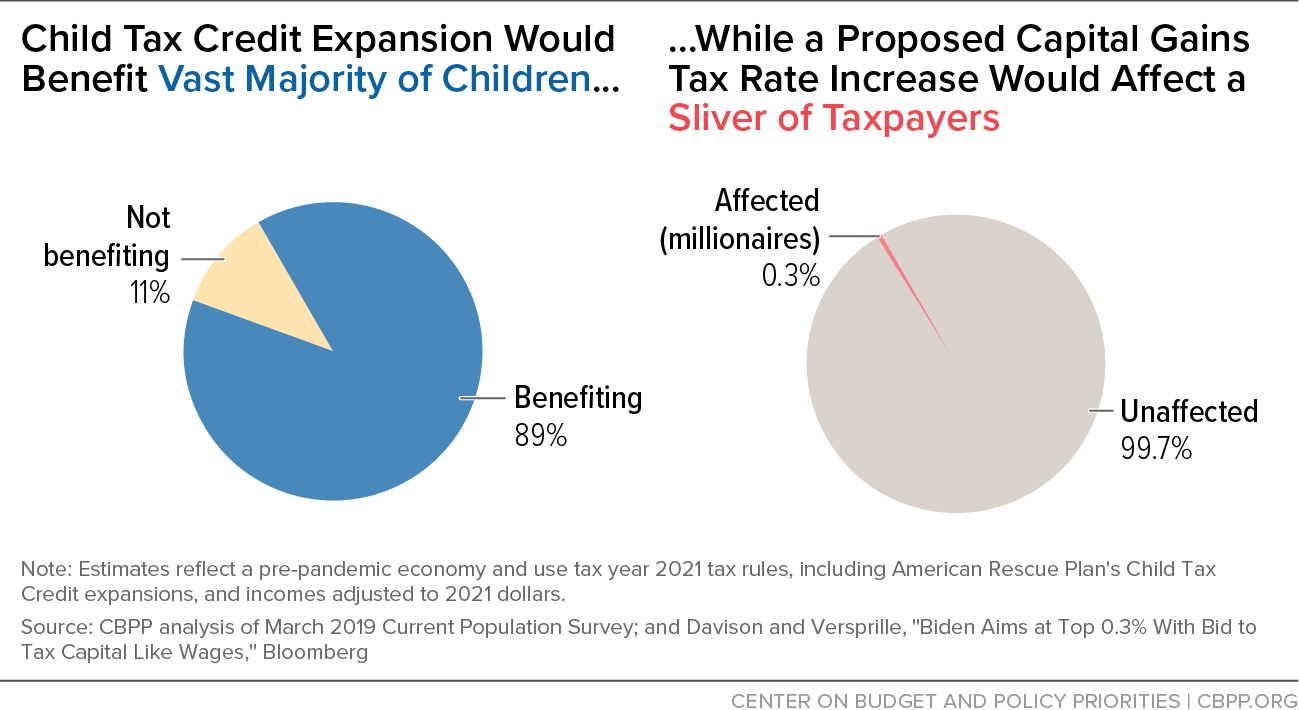

Child Tax Credit Expansion Would Benefit Vast Majority Of Children While A Proposed Capital Gains Tax Rate Increase Would Affect A Sliver Of Taxpayers Center On Budget And Policy Priorities

Capital Gains Tax In The United States Wikipedia

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

Capital Gains Tax In The United States Wikipedia

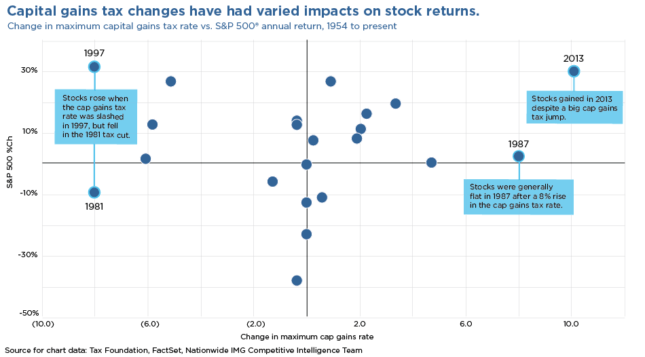

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Effect On Family Farms Of Changing Capital Gains Taxation At Death Morning Ag Clips

American Families Plan Tax Proposal A I Financial Services

Hawaii Lawmakers Advance Capital Gains Tax Increase Hawaiʻi Tax Fairness Coalition

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Capital Gains Trade Nears Potential Deadline As Legislation Looms

Short Term And Long Term Capital Gains Tax Rates By Income

Short Term Capital Gains Tax Rates For 2022 Smartasset

Concerns Rise Over Tax Increase Proposals Nationwide Financial

Managing Capital Gains Tax In 2021 And Beyond Ultimate Estate Planner

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

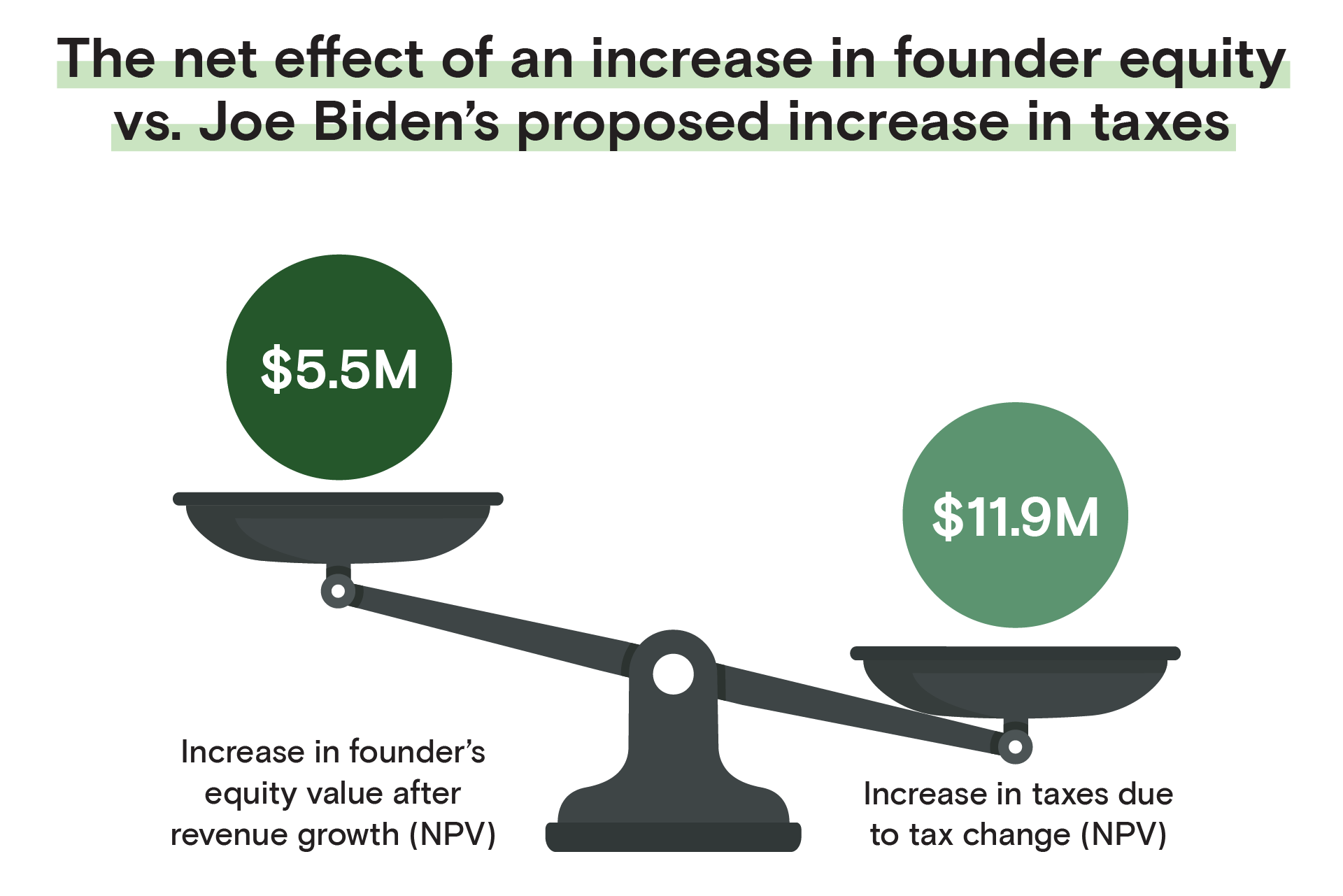

For Founders The Implications Of Joe Biden S Proposed Tax Code

State Taxes On Capital Gains Center On Budget And Policy Priorities